By Michael Townsend, Liverpool Today News

As national headlines warn of slowing house prices and wavering buyer confidence across much of the UK, the North West property market is telling a very different story, one of resilience, opportunity, and remarkable growth.

New figures have revealed that property values across the North West have risen by an eye-catching 29% since March 2020, significantly outpacing the England and Wales average of around 15% in the same period. This surge firmly positions the region, including key hotspots like Liverpool, Manchester, and Preston, as a standout for both homeowners and property investors.

Why the North West?

Unlike London and the South East, where sky-high property prices have left limited room for further growth, the North West offers something different: affordability combined with high growth potential. For many investors, this is the sweet spot. While Greater London recorded a more modest increase of just 5%, the North West’s performance illustrates a growing shift in where value is being found in the UK market.

The underlying driver behind this momentum is multi-layered. Cities such as Liverpool and Manchester continue to benefit from significant infrastructure investment, city centre regeneration, and a strong student and young professional population demanding quality rental accommodation. For landlords and buy-to-let investors, rental yields in this area are among the highest in the country, with Liverpool consistently ranking among the top UK cities for gross rental returns.

A Property Investors Market That’s Built to Last?

Despite wider economic pressures, including inflation, interest rate uncertainty, and supply chain challenges, the North West’s housing & property investors market has demonstrated real resilience. Experts cite the region’s relative affordability, solid employment growth, and steady inward investment as reasons it remains an attractive long-term prospect. Property investment companies such as Total Property Group and Downing have seen a massive surge in interest in the City.

In Liverpool, the continued transformation of areas such as the Baltic Triangle, Anfield, and the Knowledge Quarter is not only raising the city’s profile but also fueling demand for both rental and owner-occupier homes. For first-time buyers and investors alike, this provides a welcome alternative to the stagnating markets in other parts of the UK.

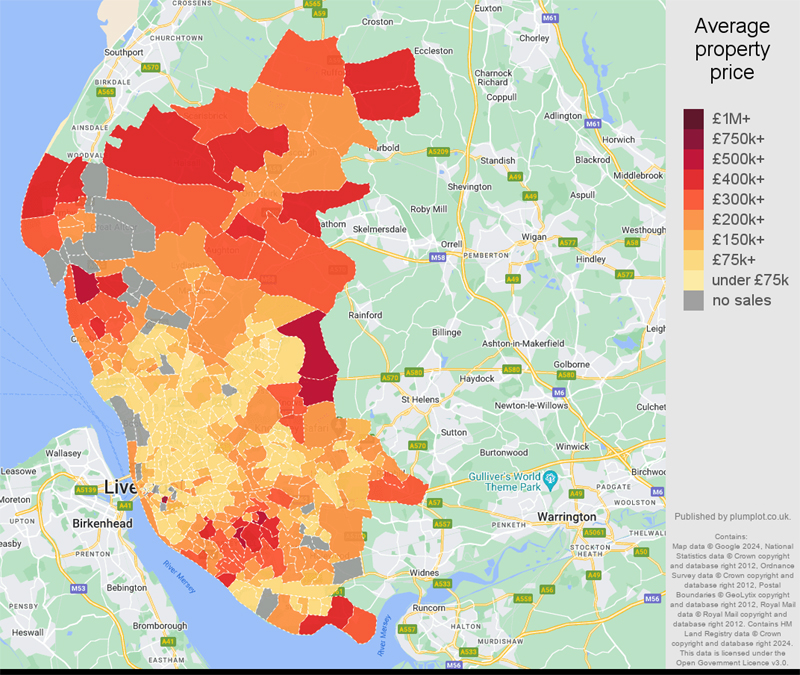

The Liverpool Region – Average Property Price Chart

The Bottom Line

The data doesn’t lie. While national averages may paint a mixed picture, the North West and Liverpool in particular are outperforming expectations. As we continue to track the market here at Liverpool Today News, one thing is clear: the North West is no longer just an affordable alternative. It’s a leading destination for wise, long-term property investment.